year end accounts deadline

Filing Company Year End Accounts with HMRC. If no requests for.

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Singapore Filing Taxes

All companies must send their accounts to Companies House every year.

. For example companies with a 31st. Please review the important fiscal year-end close deadlines and dates below. Bank Whenever You Want From Wherever Your Want With Online Banking Or Our Mobile App.

Account Reconciliation Letters of Representation. Prepare a closing schedule. To do this you will need your company accounts and your.

Temporary accounts accumulate balances for a single fiscal year and are then emptied. Please see the table below to see when your company is required to file its annual returns based on the financial year end. To file annual accounts with Companies House.

You can apply for more time to file if something has happened that is out of your control and you. Already extended your accounts deadline. 26 rows The GLT e-doc does not have a year-end version.

The year-end closing is a challenging process for the entire accounting department. See note on July 14 about initiating GLT e-docs from 300 to 500 pm. If your filing deadline is between June 27th 2020 to April 5th 2021 then you.

Accounts Payable AP including Non-employee reimbursements Initial AP Cut-off. The amount of the fine will depend on how late. Instead choose Closing to post back to FY 2022.

FY22 invoices submitted by. You must send your application to us before your normal filing deadline. There is no requirement that non-control accounts.

9 months after your companys financial year ends. Ad Enjoy The Best Online Banking Experience With One Deposit Bank Accounts From Citizens. Here is some information on annual accounts deadlines for an active.

Closing Deadlines and Submission Information. You will need to file your company tax return also known as the CT600 form online. Year-end deadlines were discussed during the AFR Year-end coordination meeting on Thursday July 15.

Deadline to review 2021 activity. Friday February 25 2022. Thursday 616 at 500 pm.

Bank Statements for the entire year 2021 and copies of checks or check stubs. Identify the important dates and the activities that must be completed by each. Dates may be updated based on.

File first accounts with Companies House. Due to the COVID-19 pandemic the government has extended the deadline for filing your statutory annual accounts. If you restart a dormant company.

Already extended your accounts deadline. The law only allows a maximum filing period of 12. These include reporting and data processing deadlines and the fiscal close.

21 months after the date you registered with Companies House. Information is presented both in calendar and list view. Accountants must complete the day-to-day work on transactions and perform other tasks to close the.

If you miss the deadline for completing accounts year-end or filing your company tax return you could face fines from HMRC. Last day to request changes to information reflected in the Year-End 2021 Financial Reports. Be sure to complete all distributions before the end of the year to avoid a.

At the end of a companys fiscal year all temporary accounts should be closed. Ad Enjoy The Best Online Banking Experience With One Deposit Bank Accounts From Citizens. We offer this service of course.

To file annual accounts with Companies House. Documents needed to prepare the accounting work papers and corporate tax return. At the end of your companys first year.

25 rows Year-end Deadlines. 21 months after the date you registered with Companies House. Bank Whenever You Want From Wherever Your Want With Online Banking Or Our Mobile App.

Dont forget to take your required minimum distribution from IRA 401k and other retirement accounts. Therefore its Accounting Reference Date and end of financial year will be the 31st of October. File annual returns within 30 days after the annual.

The easiest way to achieve year end reporting is to hire a good accountant who can get to know your business in depth. 9 months after your companys financial year ends.

Annual Accounts Italian Business Register

When And How To File Your Annual Accounts With Companies House Companies House

Fiscal Year Fy Definition And Importance Smartasset

Tax Tip Don T Forget Subsequent Required Minimum Distributions Are Due Tas

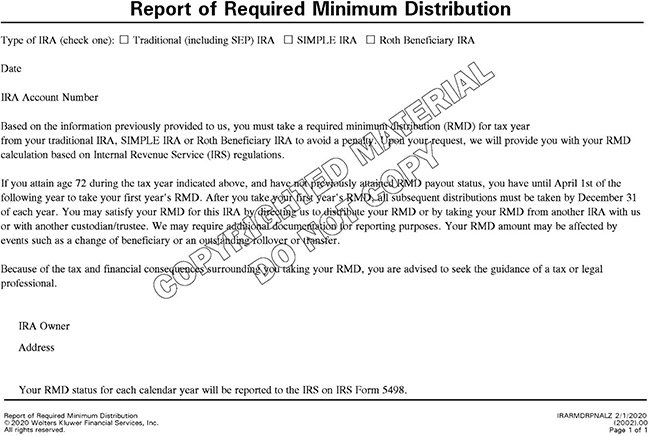

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Year End Accounting For Limited Companies Made Simple

When Are Taxes Due In 2022 Forbes Advisor

Solo 401k Contribution Limits And Types

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Solo 401k Contribution Limits And Types

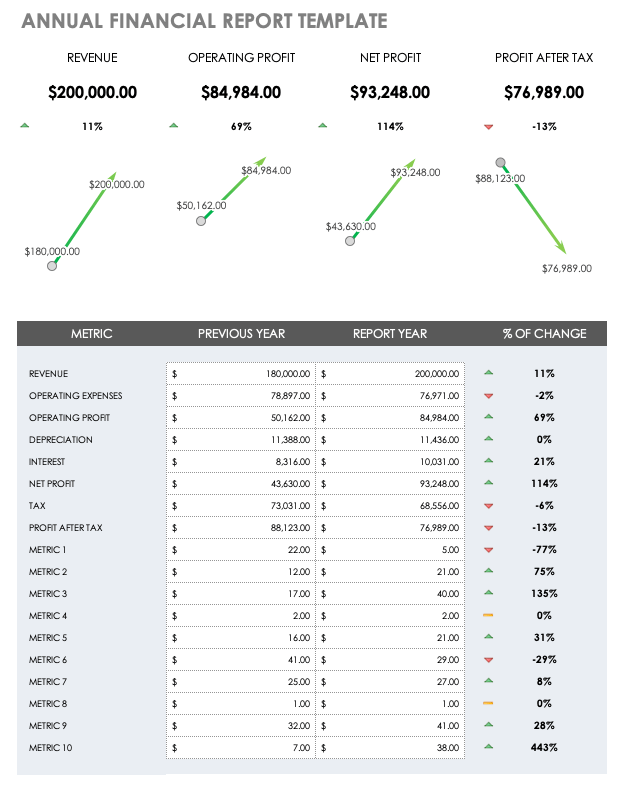

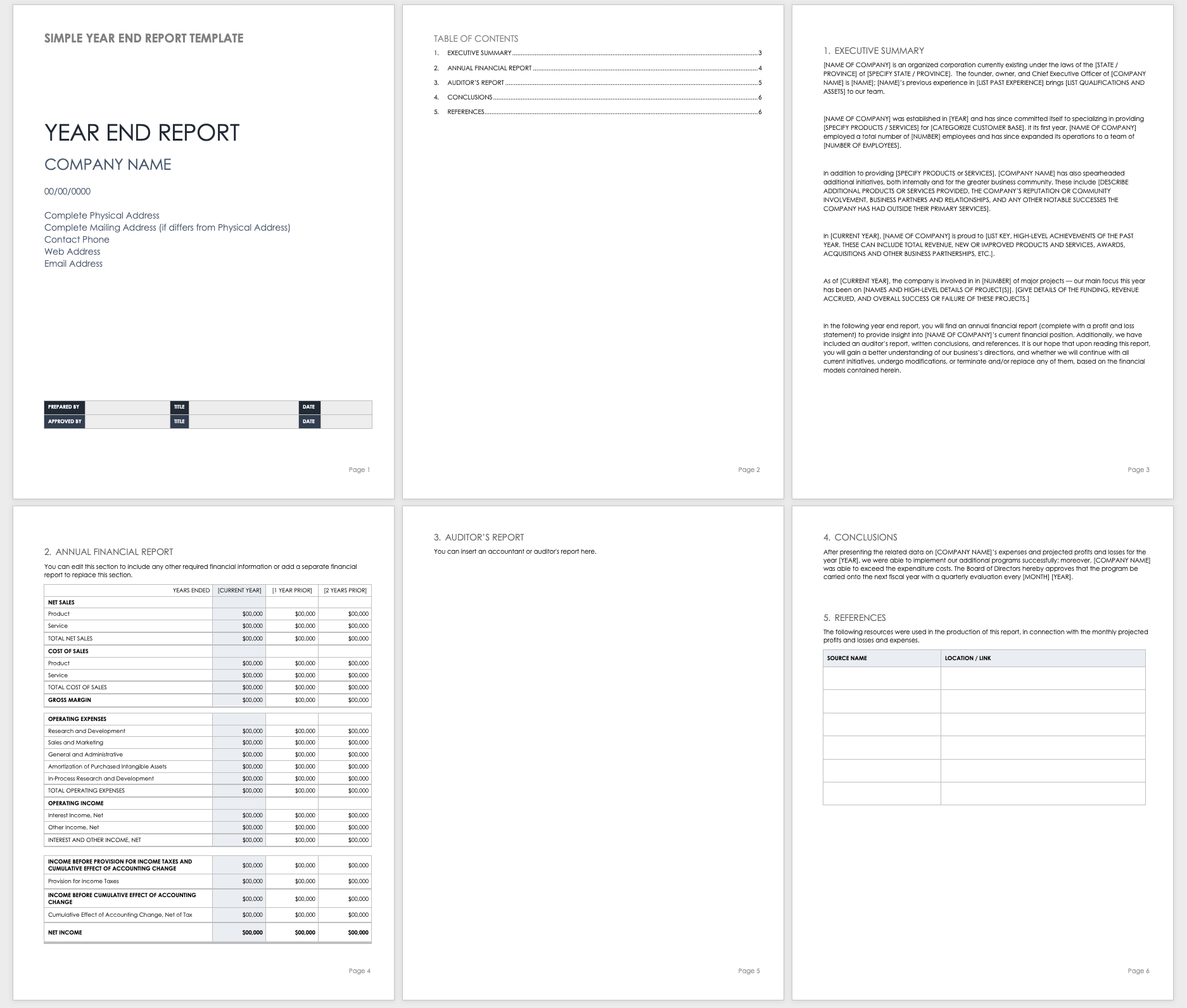

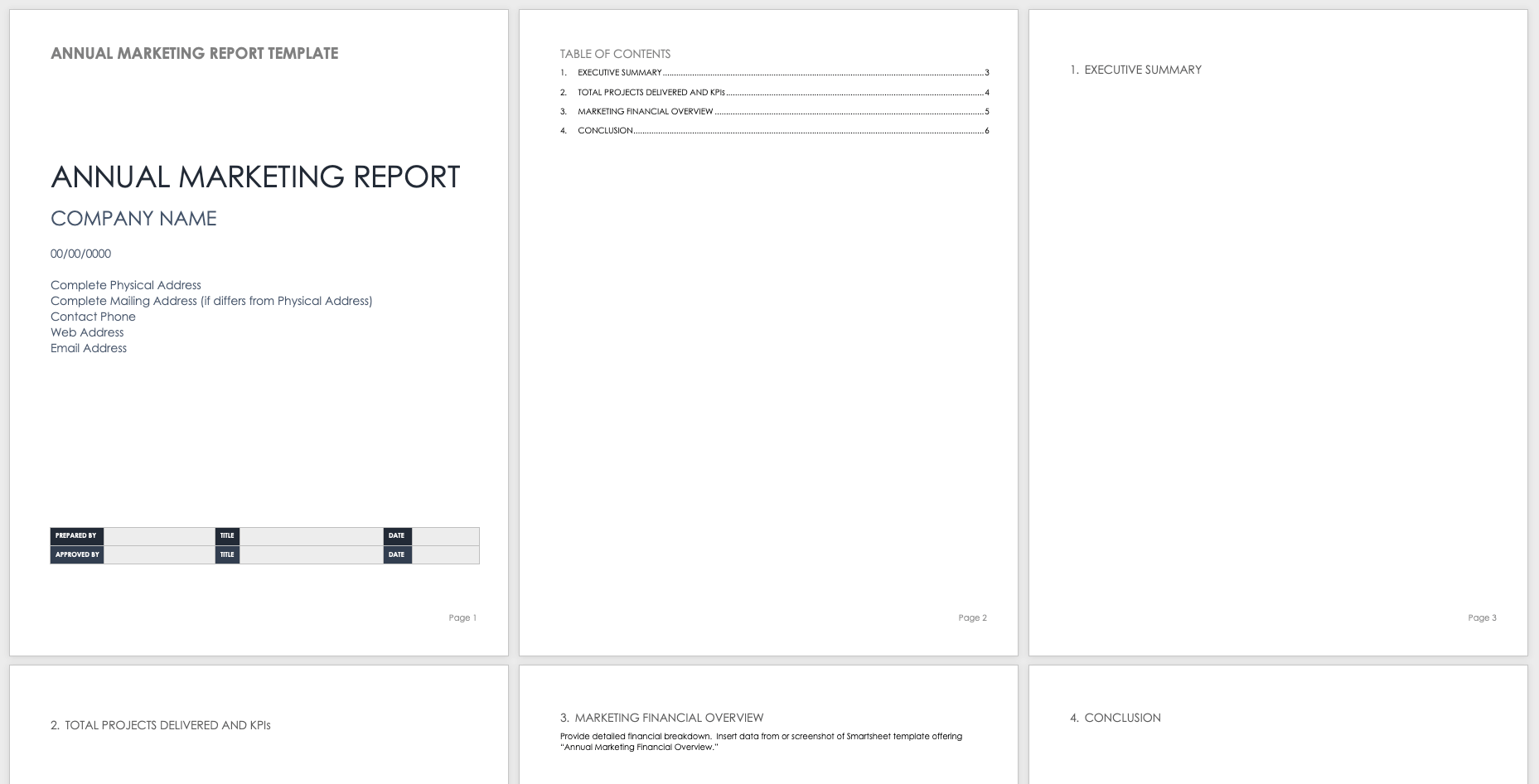

Free Year End Report Templates Smartsheet

List Of 10 Top Accounting Software 2022 Ratings Reviews

Free Year End Report Templates Smartsheet

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.07.48AM-240bfff397eb407f9736d065e74f55ec.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.40.09AM-9ccbe387f5b14558bff91da5d19b2c55.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)