washington state long term care tax opt out rules

During the last legislative session lawmakers approved. Showing results for long term care tax opt out form.

Washington State Issues New Rules For Long Term Care Fund

If you qualify for benefits in the program you can receive lifetime long-term care benefits of up to 36500.

. Washington is the first state in the nation to make long-term care more affordable for workers. Washington has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers. This is possible because starting on January 1 2022 employees.

At least 18 years of age Have long-term care insurance purchased before 1112021 Wish to opt-out of participating in the WA Cares Fund Program. In that case the tax will be. Implementation of SHB 1732 and ESHB 1733.

By contributing a small amount from each paycheck while were working we can all pay for long-term care when we need it. As a reminder in April 2021 the Washington State legislature passed a law requiring individuals to 1 pay into a long-term care fund or 2 opt out of paying into the fund by proving that they. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. Visit us at wacaresfundwagov. Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an.

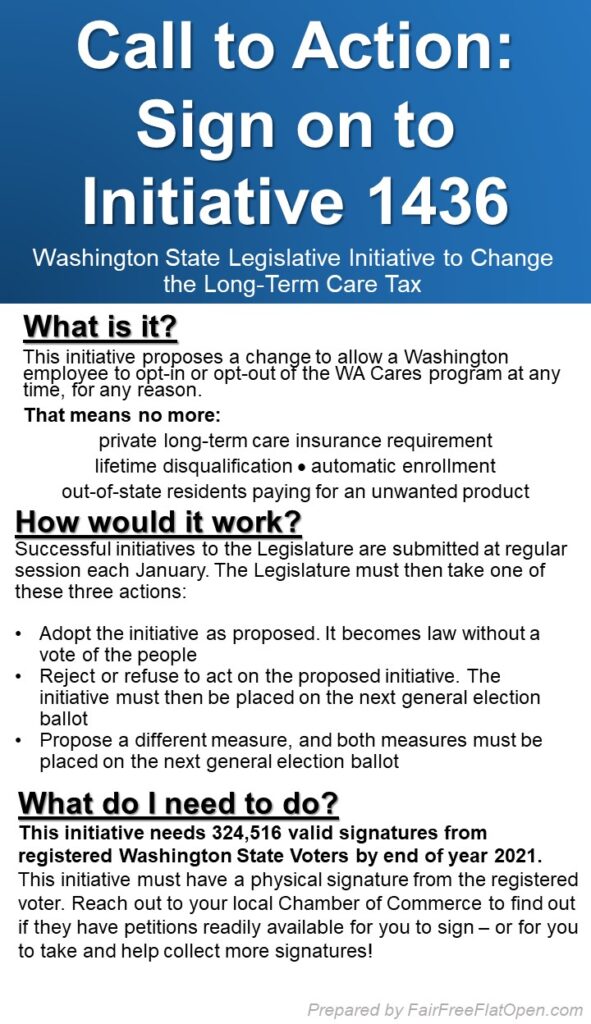

This advocacy led to an amendment adopted by the Senate that pushed the deadline for employees to purchase alternative coverage to November 1 2021. Opting back in is not an option provided in current. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline.

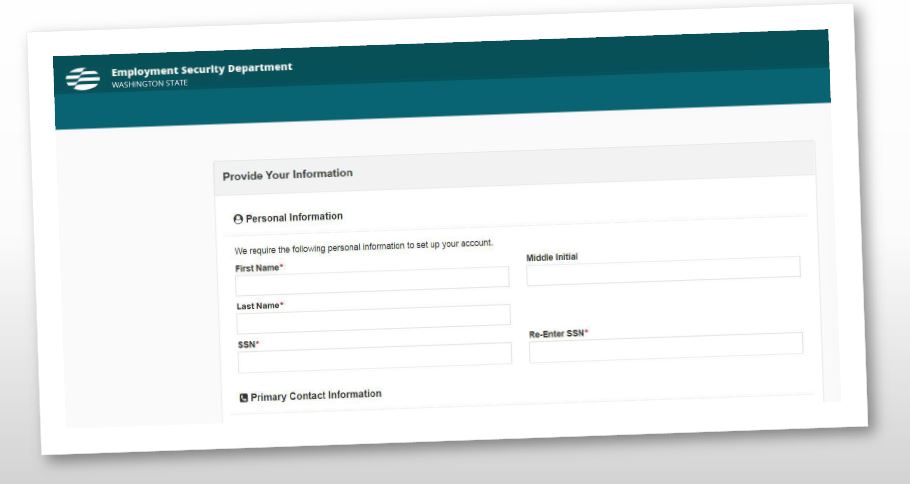

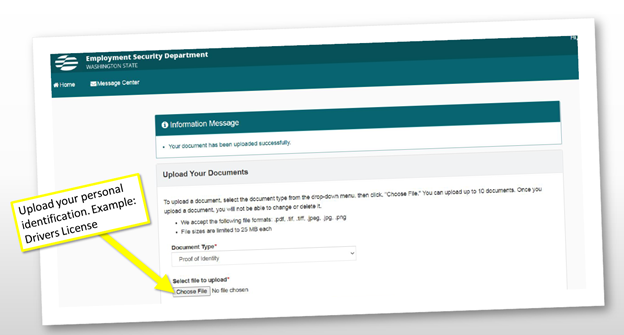

Youll need to show your employer and future employers a letter from the state that says your exemption has been approved to avoid the tax. Long-Term Services and Supports LTSS is now called WA Cares Fund. Attest that you are.

LONG-TERM CARE INSURANCE Under this law individuals will have. On January 27 2022 Washington Governor Jay Inslee signed House Bills 1732 and 1733 delaying and amending the Washington Cares Act often referred to as the Long-Term. Opting back in is not an option.

Opting out of the long-term-care payroll tax is more complicated than necessary suggesting its just a nice gesture. The governor also signed into law changes that allow those who live out of the state and work in Washington military spouses and some veterans with disabilities can opt-out of the tax. Washington State has a new law called the Washington Long Term Care Trust Act which requires employees to contribute a new payroll tax called the Washington Long-Term.

On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months. As many of us watch our parents and. The states website about the.

Washington workers who live out of state temporary workers on nonimmigrant visas spouses of active-duty military members and veterans with service-connected.

Saving For Long Term Care In Washington What To Know Ahead Of Paycheck Deductions In January King5 Com

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Washington State Retools First In The Nation Long Term Care Benefit Kaiser Health News

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Opening Day Woe And Initiative Weal Washington State Ltc Opt Out A Bust But Initiative Gathers Steam Fair Free Flat Open

Long Term Care State Payroll Tax Update Buddyins

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time Northwest Public Broadcasting

Wa State Long Term Care Insurance Tax Exemptions Information

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

How Do You Opt Out Of Washington State S Long Term Care Tax Avier Wealth Advisors

New Wa Long Term Care Tax Comes With Opt Out Alternative Tacoma News Tribune

Initiative Could Change Washington S Controversial Long Term Care Fund King5 Com

Multiple States Considering Implementing Long Term Care Tax Ltc News

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Washington Cares Payroll Tax Opt Out Is Now Open Coldstream Wealth Management